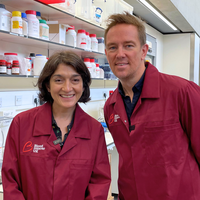

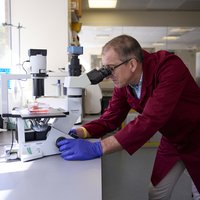

We're a community dedicated to beating blood cancer

Get InvolvedBlood Cancer UK

We research, we support, we care. Because it’s time to beat leukaemia, lymphoma, myeloma and all types of blood cancer.

How can we help?

Latest news and stories

Keep in touch with us

Get the latest news from Blood Cancer UK directly to your inbox.

We will keep you updated about our work and the ways you can help, including campaigns and events. We promise to respect your privacy and we will never sell or swap your details.